Blow it? Invest it?

- How about investing in a New home?

- Sound crazy?

Yes, there ARE programs out there that make it possible. Some with as little as 3 ½% down. Do you have equity in your property now? You don’t necessarily have to write a check for the down payments, use the equity that you already have. You can use that as all or some of your Down Payment.

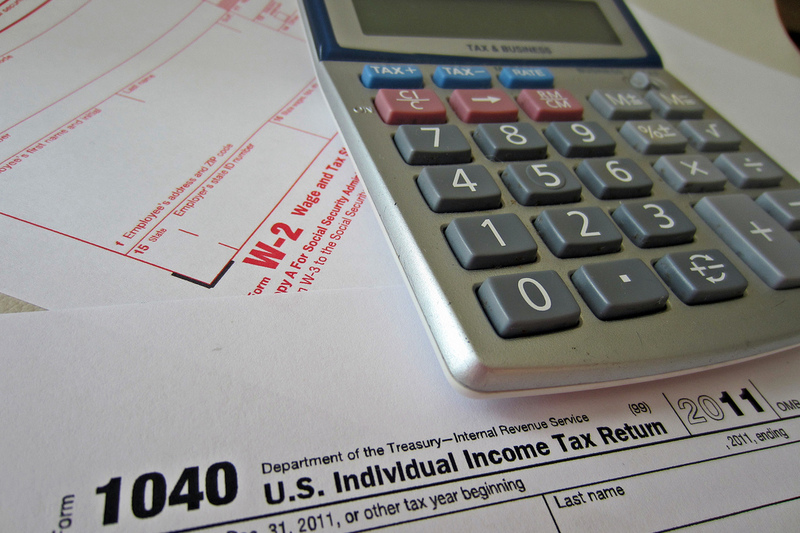

Did you know: According to the IRS, the average refund for the 2013 tax year, returns were $3,013, somewhat higher than the average for 2012 tax year returns. A tax refund of $3,000 can go a long way to a down payment on a New home, particularly if you’re using an FHA-insured loan to finance the New Home since you’d just need just 3.5% of the home price for the down payment.

The Federal Housing Authority (FHA) and the Veterans Administration (VA) offer a wide variety of mortgage loan options, including fixed-rate mortgages and ARMs. Insured or guaranteed by these government agencies, the loans feature low or no down payment terms, and may be assumable by future purchasers. VA loans are restricted to individuals qualified by military service or other entitlements, but FHA-insured loans are open to ALL qualified home purchasers. There are limits to the size of FHA/VA loans, but they’re generous enough to handle moderately priced homes anywhere in the good ol’ USA.

“Really” you say? Yes—“really”! We have built numerous homes for our valued customers that have utilized these awesome Construction Loan programs. We’re happy to be working with Brett Shaut of Huntington National Bank. A New home is a great investment that will appreciate in value the longer you own it. We strive to help our customers realize the benefits and value of owning a New Custom Home.